frugalfortunes

What Does BTC Mean?

What Does BTC Mean?

Hey there! If you’ve landed on this page, you’re probably wondering what the heck “BTC” means. Maybe you heard someone mention it at a party, or perhaps you’ve seen it pop up on your social media feed. Whatever the case, you’ve come to the right place. Let’s dive deep into the world of BTC and uncover everything you need to know about this mysterious acronym.

BTC: The Basics

BTC stands for Bitcoin, which is a type of cryptocurrency. Now, before your eyes glaze over at the word “cryptocurrency,” let me break it down for you in simpler terms. Bitcoin is a form of digital money that exists solely on the internet. It’s not physical like the cash in your wallet, and it’s not controlled by any government or central authority. Pretty cool, right?

A Brief History of Bitcoin

Bitcoin was created in 2008 by an anonymous person (or group of people) using the pseudonym Satoshi Nakamoto. The idea was to create a new kind of money that didn’t rely on banks or any central institution to operate. In 2009, Bitcoin was officially launched as open-source software, meaning anyone could look at the code and even contribute to its development.

The first-ever Bitcoin transaction happened on May 22, 2010, when a guy named Laszlo Hanyecz paid 10,000 BTC for two pizzas. At the time, those Bitcoins were worth about $41. Today, 10,000 BTC would be worth millions of dollars. Imagine buying pizza for that price now!

How Does Bitcoin Work?

Okay, so we’ve established that Bitcoin is digital money, but how does it actually work? To understand this, we need to talk about a few key concepts: blockchain, mining, and wallets.

Blockchain

At the heart of Bitcoin is something called the blockchain. Think of the blockchain as a giant digital ledger that records every Bitcoin transaction ever made. This ledger is distributed across thousands of computers around the world, making it extremely difficult to alter or hack. When someone sends Bitcoin to another person, the transaction is added to the blockchain for everyone to see (well, everyone who has the right software).

Mining

No, we’re not talking about digging up gold here. Bitcoin mining is the process by which new Bitcoins are created and transactions are added to the blockchain. Miners use powerful computers to solve complex mathematical problems. When they solve one of these problems, they get to add a new block of transactions to the blockchain and are rewarded with a certain number of new Bitcoins. This process is what keeps the Bitcoin network secure and running smoothly.

Wallets

To use Bitcoin, you need a digital wallet. This is a piece of software that allows you to store, send, and receive Bitcoin. Each wallet has a unique address, kind of like an email address, that you can use to receive Bitcoin from others. There are different types of wallets, including online wallets, mobile wallets, and hardware wallets (which are physical devices that store your Bitcoin offline for extra security).

Why Bitcoin Matters

You might be wondering why Bitcoin is such a big deal. After all, we already have plenty of ways to pay for things, right? Well, Bitcoin brings several unique advantages to the table:

Decentralization

One of the biggest benefits of Bitcoin is that it’s decentralized. This means no single entity (like a bank or government) controls it. Instead, the power is distributed across the entire network of users. This makes Bitcoin more resistant to censorship and corruption.

Security

Thanks to the blockchain and the process of mining, Bitcoin is incredibly secure. Transactions are verified by multiple parties and recorded on the blockchain, making it nearly impossible to alter or fake a transaction. Plus, with your private keys (more on that in a bit), you’re the only one who can access your Bitcoin.

Privacy

While Bitcoin transactions are recorded on a public ledger, they can still offer a level of privacy that traditional financial systems don’t. When you make a Bitcoin transaction, your personal information isn’t attached to it. Instead, you’re identified by your wallet address. This makes it harder for someone to link a transaction back to you.

Accessibility

Bitcoin can be accessed by anyone with an internet connection, making it a valuable tool for people in countries with unstable or restricted financial systems. You don’t need a bank account to use Bitcoin, and you can send and receive it from anywhere in the world with minimal fees.

The Value of Bitcoin

If you’ve heard anything about Bitcoin in the news, it’s probably been about its price. Bitcoin’s value can be incredibly volatile, meaning it can go up and down a lot in a short period of time. This volatility is partly due to the fact that Bitcoin is still a relatively new and emerging technology.

Bitcoin’s price is determined by supply and demand. There will only ever be 21 million Bitcoins in existence, which creates scarcity. When more people want to buy Bitcoin than there are Bitcoins available, the price goes up. Conversely, when more people want to sell Bitcoin than there are buyers, the price goes down.

Buying and Using Bitcoin

So, how do you actually get your hands on some Bitcoin? There are a few different ways to buy Bitcoin:

Exchanges

The most common way to buy Bitcoin is through a cryptocurrency exchange. These are online platforms where you can buy, sell, and trade Bitcoin and other cryptocurrencies. Some popular exchanges include Coinbase, Binance, and Kraken. You’ll need to create an account, verify your identity, and link a payment method (like a bank account or credit card) to buy Bitcoin.

Peer-to-Peer

Another way to buy Bitcoin is through peer-to-peer (P2P) platforms. These platforms connect buyers and sellers directly, allowing them to negotiate prices and payment methods. Examples of P2P platforms include LocalBitcoins and Paxful.

Bitcoin ATMs

Believe it or not, there are ATMs specifically for Bitcoin! These machines allow you to buy Bitcoin with cash or a credit card. You can find Bitcoin ATMs in many cities around the world.

Once you’ve got some Bitcoin, you can use it in a variety of ways:

Online Purchases

More and more online retailers are accepting Bitcoin as a form of payment. You can buy everything from electronics to clothing to travel accommodations using Bitcoin.

Investing

Many people buy Bitcoin as an investment, hoping that its value will increase over time. There are also various financial products, like Bitcoin ETFs (exchange-traded funds), that allow you to invest in Bitcoin without actually owning it.

Sending Money

Bitcoin is a great way to send money to friends and family, especially if they live in another country. The transaction fees are usually lower than traditional money transfer services, and the process is much faster.

The Risks of Bitcoin

Of course, Bitcoin isn’t all sunshine and rainbows. There are some risks and challenges to be aware of:

Volatility

As mentioned earlier, Bitcoin’s price can be extremely volatile. This means you could buy Bitcoin today and see its value drop significantly tomorrow. If you’re thinking about investing in Bitcoin, be prepared for a wild ride.

Security

While Bitcoin itself is very secure, the same can’t always be said for the platforms and wallets that store it. There have been numerous instances of exchanges getting hacked and people losing their Bitcoin. It’s important to use reputable exchanges and wallets, and to take extra security measures like using two-factor authentication and keeping your private keys safe.

Regulation

The regulatory environment for Bitcoin is still evolving. Some countries have embraced Bitcoin and cryptocurrencies, while others have banned or heavily restricted them. It’s important to stay informed about the laws and regulations in your country.

Check out this Free Video Report!>>>

The Future of Bitcoin

So, what does the future hold for Bitcoin? It’s hard to say for sure, but there are a few trends and developments worth keeping an eye on:

Institutional Adoption

More and more institutional investors (like hedge funds and large corporations) are getting involved in Bitcoin. This could help stabilize its price and increase its legitimacy as an asset class.

Technological Improvements

The Bitcoin network is constantly being improved and upgraded. For example, the Lightning Network is a second-layer solution that aims to make Bitcoin transactions faster and cheaper.

Mainstream Acceptance

As Bitcoin becomes more widely accepted by retailers and payment processors, it could become a more mainstream form of money. This increased acceptance could drive up demand and, consequently, its value.

Final Thoughts

So, there you have it! BTC stands for Bitcoin, a revolutionary form of digital money that operates without the need for banks or central authorities. It’s built on a secure and transparent technology called blockchain, and it offers several advantages like decentralization, security, privacy, and accessibility. However, it’s also important to be aware of the risks, including its volatility, security concerns, and regulatory uncertainties.

Whether you’re thinking about buying some Bitcoin, using it for online purchases, or just curious about what all the fuss is about, I hope this guide has given you a better understanding of what BTC means and why it’s such a big deal. Thanks for reading, and happy Bitcoining!

Work from Home Jobs No Experience Required!

Introduction

Are you tired of the daily grind of commuting to the office, battling traffic, and dealing with an unyielding boss? Well, you’re not alone! The global workforce is undergoing a monumental shift towards remote work, and there’s never been a better time to jump on board. But what if you lack experience in the field you’re interested in? Fear not! In this comprehensive guide, we’re going to unravel the secret world of “work from home jobs no experience.” Yes, you read that right—jobs that don’t require any prior experience. Buckle up, because we’re about to take you on a journey through a multitude of opportunities that can turn your dream of working from the comfort of your home into a reality!

Exploring the Realm of Work from Home Jobs

When it comes to work from home jobs, many people assume they need an extensive resume filled with relevant experience. However, the truth is, there’s a wide array of remote positions that are perfect for beginners. Whether you’re a recent graduate, a stay-at-home parent looking to reenter the workforce, or simply seeking a change in your career path, there’s something out there for you. Let’s dive in and explore the exciting world of work from home jobs no experience required.

1. Virtual Assistance: Your Gateway to Remote Work

Imagine waking up, brewing your favorite coffee, and then starting your workday in your pajamas—it’s not a fantasy anymore! Becoming a virtual assistant (VA) is one of the most accessible ways to kickstart your work from home journey. As a VA, you’ll provide administrative support to businesses or entrepreneurs, helping them manage emails, schedules, and various tasks. Here’s why it’s a great option:

- No experience? No problem! Basic organizational and communication skills are all you need.

- Flexible hours allow you to balance work with other commitments.

- You’ll develop a broad skill set that can open doors to more specialized roles later.

2. Content Creation: Utilize the Power of YouTube!

If you have a computer (or even just a smartphone), content creation might be your calling. The world at large is hungry for fresh content, and you can be the one to provide it! Here’s why this is an excellent work from home job with no experience required:

- Creating YouTube videos doesn’t require a formal education.

- You can start your YouTube channel career even without prior experience.

- Your creativity is your most valuable asset—let it shine!

3. Data Entry: The Gateway to Remote Employment

Data entry jobs may not be the most glamorous, but they’re a fantastic entry point into remote work. If you’re detail-oriented and can navigate a keyboard like a pro, you’re well on your way to securing a data entry position. Here’s why it’s a solid choice for beginners:

- Most data entry positions are beginner-friendly and don’t require previous experience.

- You can work at your own pace, making it suitable for individuals who want to ease into remote work.

- Many companies offer training, so you can quickly get up to speed.

4. Social Media Management: Perform Simple Social Media Sharing

Do you enjoy using social media? If so, working as a social media manager from the comfort of your home could be an ideal fit. Many companies provide comprehensive training, so you can excel even without prior experience:

- You can get paid for simply posting images, liking and commenting on Social Media platforms.

- Social Media Management positions are in high demand, providing numerous job opportunities.

- You can utilize various social media platforms including Facebook, Instagram, TikTok, and Pinterest.

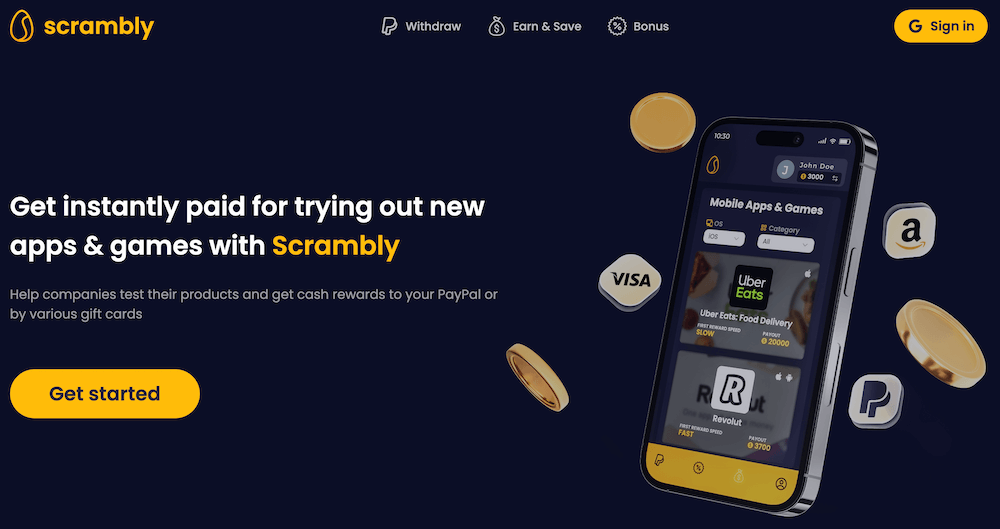

5. Play Games and Try New Apps: Make Money from Your Opinions

Have you ever thought your opinions and simply testing out new apps and games could earn you money? Well, they can! Participating in market research studies is a legitimate way to earn income from home. Here’s why this is a no-experience-required gig:

- Simply sharing your thoughts and preferences can help companies improve their products and services.

- Numerous legitimate survey websites and market research firms are looking for participants.

- It’s a flexible way to earn extra income without the need for any specialized skills.

- Check out Scrambly!

Frequently Asked Questions

Now that we’ve highlighted some fantastic work from home jobs with no experience required, you might have a few burning questions. Let’s address those FAQs!

FAQ 1: Can I Really Get a Legitimate Work from Home Job with No Experience?

Absolutely! Many legitimate companies value qualities like dedication, reliability, and the ability to learn quickly over specific job experience. The jobs we’ve mentioned, such as virtual assistance, content creation, and data entry, are perfect examples of opportunities where you can start fresh.

FAQ 2: How Do I Avoid Work-from-Home Scams?

While there are genuine remote job opportunities, scams do exist. To steer clear of scams, remember these tips:

- Research the company thoroughly before applying.

- Never pay upfront fees for job opportunities.

- Be cautious if the job offer seems too good to be true.

FAQ 3: Do I Need Special Equipment to Work from Home?

The equipment you need depends on the job. For most remote positions, a computer with internet access is essential. Some roles might require specific software or equipment, but these are usually provided by the employer.

FAQ 4: Are These Jobs Lucrative?

The income potential varies depending on the job and your level of commitment. Virtual assistants, content creators, and data entry clerks can earn competitive salaries, especially as they gain experience. Customer service representatives and survey participants can also earn decent supplemental income.

FAQ 5: How Do I Get Started?

Getting started is easier than you might think:

- Update your resume and cover letter, highlighting relevant skills and qualities.

- Start searching for remote job opportunities on job boards, company websites, and freelancing platforms.

- Apply to positions that match your skills and interests.

- Prepare for interviews by researching the company and practicing common interview questions.

Conclusion

In conclusion, the world of work from home jobs no experience needed is more accessible than ever. Whether you’re a recent graduate, a parent looking to balance work and family, or someone seeking a career change, there are plenty of opportunities waiting for you. From virtual assistance to content creation, data entry, customer service, and participating in online surveys, the possibilities are vast.

Remember, success in the remote workforce is not solely determined by your past experiences. Employers value qualities like dedication, adaptability, and strong communication skills. So, take the leap, explore these opportunities, and start your journey toward a fulfilling work-from-home career today. Don’t let the lack of experience hold you back—embrace the future of work on your terms!

Riding the Waves: How the Debt Ceiling Impacts the Housing Market

Debt Ceiling & the Housing Market Introduction

Ah, the ever-elusive debt ceiling! It’s like that mythical sea monster lurking beneath the surface, capable of making the financial seas tumultuous for all. But what does it have to do with the housing market, you ask? Well, dear reader, you’re about to embark on a voyage through the turbulent waters of economics and real estate, where we’ll unravel the mysteries of the debt ceiling and its impact on the housing market. Hold on tight; it’s going to be a wild ride!

The Debt Ceiling Demystified

Before we dive headfirst into the housing market, let’s first untangle the web of the debt ceiling.

What is the Debt Ceiling, Anyway?

The debt ceiling, also known as the debt limit, is like the credit card limit for the United States government. It’s the maximum amount of money that the government is allowed to borrow to meet its financial obligations. This includes paying for things like Social Security, Medicare, and, importantly for our discussion, servicing the national debt.

Now, here’s the kicker: the government doesn’t set its own debt ceiling. It’s determined by Congress, the folks on Capitol Hill. When they raise it, it’s like increasing their credit card limit; when they don’t, well, they better have some creative budgeting skills up their sleeves.

Why Does the Debt Ceiling Matter?

The debt ceiling is like a financial fence that keeps the government’s spending in check. When it’s raised, it allows the government to meet its existing financial commitments without defaulting on its debt. Failure to raise it can lead to a government shutdown and, more ominously, the possibility of defaulting on its debt.

The Housing Market Rollercoaster

Now that we’ve got a handle on the debt ceiling, let’s see how it intertwines with the housing market, shall we?

The Dance of Interest Rates

Ah, interest rates, the heartbeat of the housing market! They determine how expensive it is to borrow money to buy a home. The debt ceiling has a fascinating sway over these rates.

- When the debt ceiling is raised: It’s like a sigh of relief for the housing market. The government can meet its obligations without resorting to drastic measures, like reducing spending. This stability often leads to lower interest rates, making mortgages more affordable.

- When the debt ceiling isn’t raised: Well, that’s a different story. If the government teeters on the edge of default, lenders get nervous. They might demand higher interest rates to compensate for the perceived risk. This can make home loans more expensive, potentially dampening the housing market.

Investor Confidence and Uncertainty

Investors in the housing market are a cautious bunch, and they don’t like uncertainty one bit. The debt ceiling debates in Congress can create a lot of uncertainty.

- When the debt ceiling is raised without much drama: Investors breathe a sigh of relief. They see a stable government and are more inclined to invest in real estate, buoying the housing market.

- When the debt ceiling becomes a political battleground: Oh boy, here comes the rollercoaster drop! Investors get jittery. They may pull back from the housing market, fearing economic turmoil. This can lead to decreased demand for homes and a potential drop in prices.

The Great Recession: A Case Study

If you’re still not convinced of the debt ceiling’s impact on the housing market, let’s take a look at a real-life example: the Great Recession of 2008.

The Prelude

In the years leading up to the Great Recession, the debt ceiling was raised several times with relatively little fuss. This stability helped keep interest rates low, fueling a housing market boom.

The Climax

But then came the financial crisis of 2008, and with it, a showdown in Congress over the debt ceiling. It wasn’t raised quickly or easily, and this political drama sent shockwaves through the economy.

- Interest rates began to rise as investors grew anxious, making mortgages more expensive.

- Home prices started to plummet as demand dropped, and foreclosures surged.

- The housing market, once a thriving hub of activity, became a ghost town, with empty homes and “For Sale” signs as far as the eye could see.

The Fallout

The Great Recession served as a stark reminder of how closely tied the debt ceiling and the housing market can be. The housing market crash was a direct consequence of the economic turmoil caused by the debt ceiling debacle.

FAQs: Your Burning Questions Answered

Now that we’ve explored the debt ceiling’s impact on the housing market, let’s address some of the burning questions you might have.

1. Can the debt ceiling directly affect my mortgage rate?

Absolutely! When the debt ceiling is in turmoil, interest rates can fluctuate. This directly impacts your mortgage rate, potentially making it more expensive to finance your home.

2. Should I put off buying a home during a debt ceiling crisis?

It depends. If you can time your purchase during a stable period, you might snag a better deal. However, don’t let the debt ceiling be the sole deciding factor; other market conditions and personal finances play crucial roles too.

3. What can I do to protect my real estate investments during a debt ceiling standoff?

Diversification is your friend. Don’t put all your real estate eggs in one basket. Spread your investments across different properties and locations to mitigate risk. Additionally, keep an eye on the debt ceiling discussions and be prepared to adapt your strategy accordingly.

4. How can I stay informed about the debt ceiling’s impact on the housing market?

Stay plugged into financial news, follow housing market trends, and consult with a real estate expert. They can help you navigate the turbulent waters of the market during debt ceiling fluctuations.

Conclusion: Riding the Waves

In the unpredictable world of real estate, the debt ceiling is like the weather – it can be calm and sunny or stormy and turbulent. Its impact on the housing market is undeniable, affecting everything from interest rates to investor confidence.

As a prospective homeowner or investor, it’s crucial to keep an eye on the debt ceiling’s movements and be prepared to adjust your strategy accordingly. The key to success in the housing market, much like riding the waves, is staying informed, adaptable, and ready to navigate the highs and lows with skill and confidence.

So, whether you’re dreaming of your first home or expanding your real estate portfolio, remember that the debt ceiling is just one more wave in the vast sea of opportunity that is the housing market. Stay informed, stay flexible, and ride those waves to your real estate success! 🏡🌊

Mastering YouTube Automation

Introduction: Embracing the YouTube Automation Wave

Are you tired of the relentless grind of content creation on YouTube? Do you find yourself constantly wrestling with video editing software, keyword research, and publishing schedules? Well, fret not, because a revolutionary wave is sweeping across the YouTube landscape: YouTube automation! In this era of digital innovation, where time is a precious commodity, automation is the game-changer you’ve been waiting for.

Imagine a world where your YouTube channel runs like a well-oiled machine, freeing you to focus on what you do best – creating captivating content! In this article, we’ll take you on a journey through the exciting realm of YouTube automation, exploring its potential, benefits, and practical applications. Get ready to unlock your creativity and take your channel to new heights!

The Power of YouTube Automation

What Is YouTube Automation, Anyway?

Let’s start with the basics: What is YouTube automation? Put simply, it’s the art of leveraging technology and tools to streamline various aspects of your YouTube channel’s operation. From video creation and editing to SEO optimization and audience engagement, YouTube automation encompasses a wide range of tasks.

How Does It Work?

YouTube automation operates through a series of algorithms and predefined rules, allowing you to automate repetitive tasks. Here’s a brief overview of how it works:

- Content Creation: Automation tools can help generate video titles, descriptions, and even scripts based on your niche and target audience.

- Video Editing: Automate video editing processes like adding intros, outros, captions, and even special effects.

- SEO Optimization: Optimize your video’s metadata, including tags, keywords, and descriptions, to enhance discoverability.

- Scheduling and Publishing: Set a publishing schedule in advance, ensuring consistency without manual intervention.

- Audience Engagement: Use chatbots and automated responses to engage with your audience promptly.

Unleashing Your Creativity with YouTube Automation

The Creative Freedom You Deserve

With YouTube automation taking care of the mundane tasks, you’ll have more time and energy to focus on what truly matters – your creative content! Here’s how it empowers your creativity:

1. Faster Video Production

No more spending hours editing videos or researching keywords. Automation tools speed up these processes, allowing you to produce more content in less time.

2. Consistent Branding

Maintain a consistent brand identity across your videos effortlessly. Automation ensures that intros, outros, and graphic elements are uniform, reinforcing your brand image.

3. Data-Driven Content

Leverage data analytics and automation to identify trends and audience preferences. Craft content that resonates with your viewers, increasing engagement and growth.

4. Expanding Your Content Portfolio

With automation handling the routine tasks, you can experiment with different video formats and explore new content ideas without being bogged down by logistics.

Practical Applications of YouTube Automation

Boosting Your Channel’s Performance

Now that you understand the concept, let’s dive into the practical applications of YouTube automation and how it can supercharge your channel’s performance!

1. Keyword Research and SEO Optimization

Automated tools can identify high-traffic keywords, analyze competitors, and optimize your video’s metadata for better search engine rankings. This means more eyeballs on your content!

2. Video Editing

Say goodbye to time-consuming editing tasks. Automation tools can cut, trim, add music, and even apply special effects to your videos, ensuring a polished end product.

3. Scheduling and Publishing

Consistency is key on YouTube. Automation lets you schedule video uploads at optimal times, ensuring your content reaches the widest audience possible.

4. Audience Engagement

Engaging with your audience is crucial for building a loyal fan base. Automation can handle routine responses, freeing you to engage with viewers on a deeper level.

FAQs: Clearing Your Doubts

Q1: Is YouTube Automation Safe?

Absolutely! YouTube automation tools comply with YouTube’s terms of service, ensuring your channel’s safety. Just be cautious of spammy practices that may harm your reputation.

Q2: Do I Lose Control Over My Channel?

Not at all! You retain full creative control. Automation tools are your allies, simplifying tasks and allowing you to focus on content quality.

Q3: Are Automation Tools Expensive?

While some tools come with a price tag, many offer free versions with basic features. The investment is often worth it when considering the time and effort saved.

Q4: Can Automation Hurt My Channel’s Authenticity?

It’s all about how you use automation. Maintain a balance between automation and your personal touch to keep your channel authentic.

The Future of YouTube: Automation and Beyond

As we embrace the era of YouTube automation, we must also anticipate what lies ahead in the world of content creation. Here are some trends to watch out for:

1. AI-Generated Content

Artificial intelligence is evolving rapidly, and we may soon see AI-generated videos that mimic human creativity. This could open up new possibilities for content creation.

2. Personalized Viewer Experiences

Automation will continue to play a crucial role in tailoring content to individual viewers. Expect more personalized recommendations and interactive features.

3. Enhanced Analytics

Data analytics tools will become even more sophisticated, providing creators with deeper insights into audience behavior and content performance.

Conclusion: Embrace the YouTube Automation Revolution!

In a world where time is the most precious resource, YouTube automation emerges as a superhero for content creators. It’s not about replacing your creativity; it’s about amplifying it. By harnessing the power of automation, you can elevate your YouTube channel to new heights, engage with your audience more effectively, and explore uncharted creative territories.

So, don’t be left behind in the digital dust! Embrace YouTube automation, streamline your workflow, and watch your channel flourish like never before. This is the creative revolution you’ve been waiting for – seize it, and let your content shine brighter than ever in the world of YouTube!

Are you ready to revolutionize your YouTube journey with automation? Join the wave today, and remember, the future of content creation is now, and it’s incredibly exciting! 🚀

Scrambly – A New Favorite Side Hustle!

Unlocking Your Side Hustle Potential with Scrambly

In today’s fast-paced world, having a side hustle has become more than just a trend; it’s a necessity. Whether you want to pay off debt, save for a dream vacation, or simply have some extra cash in your pocket, a side hustle can be a game-changer. And if you’re looking for a side hustle that’s not only lucrative but also fun and flexible, look no further than Scrambly. In this article, we’ll dive deep into the world of Scrambly and explore how it can help you unlock your side hustle potential.

What is Scrambly?

Let’s start with the basics. Scrambly is a unique online platform that offers a wide range of opportunities for individuals to earn money through various tasks and activities. It’s not your typical side hustle; it’s a dynamic ecosystem that allows you to leverage your skills and interests to generate income. Whether you’re a student, a stay-at-home parent, or a full-time professional looking to supplement your income, Scrambly has something for everyone.

The platform allows you the ability to earn money by playing games, testing apps, taking surveys, and new trying out new products.

Getting Started with Scrambly

So, how do you get started? It’s as easy as 1-2-3:

- Sign Up: The first step is to create an account on Scrambly. It’s a straightforward process that takes just a few minutes. All you need is a valid gmail address, and you’re good to go.

- Explore Opportunities: Once you’re registered, you can start exploring the various opportunities available on the platform. There are Apps and Games for IOS, Android, and Desktop. There are also tasks you can earn from in the Finance, Entertainment and Services areas. New opportunities are always being added to be sure to check back frequently.

- Start Earning: After you’ve identified an opportunity that suits your skills and interests, you can start working on it. The more you work, the more you earn. It’s that simple. As far as earning potential, it all depends on how much time an effort you put into it. Having said that, Scrambly users earn on average $27/day. That’s not bad at all for a side hustle!

Why Choose Scrambly for Your Side Hustle?

Now that you know what Scrambly is, let’s dig deeper into why it’s an excellent choice for your side hustle:

1. Flexibility

One of the most significant advantages of using this platform is its flexibility. You can work whenever and wherever you want. Whether you’re a night owl or an early bird, you can find tasks that fit your schedule.

2. Diverse Opportunities

As mentioned previously, Scrambly offers a wide range of opportunities across different industries. From playing games and testing apps to participating in online surveys, there’s something for everyone. This diversity allows you to explore your interests and expand your skillset.

3. No Experience Required

You don’t need years of experience to get started on Scrambly. Many tasks are beginner-friendly and provide an excellent opportunity for individuals looking to gain experience in various fields.

4. Extra Income

Imagine having some extra cash for that weekend getaway, or being able to treat yourself to your favorite restaurant without worrying about your budget. Scrambly.io can help you achieve those financial goals.

On the FAQ section of the website it states that it is very possible to earn anywhere from $100 to $1000+ monthly income, depending on the amount of time and effort you are willing to put into it.

Tips for Maximizing Your Earnings on Scrambly

To make the most of your side hustle on Scrambly, consider these tips:

1. Consistency

Consistency and quality work will help you to earn the most on the platform. As the saying goes, “the more you put into it, the more you will get out of it”.

2. Time Management

Effective time management is key. Set realistic goals and allocate dedicated time for your Scrambly tasks to ensure productivity.

3. Skill Enhancement

Don’t limit yourself to your current skillset. Consider taking online courses or tutorials to improve your skills so that you can maximum your earning potential on the platform.

Is Scrambly Right for You?

Before you dive headfirst into Scrambly, it’s essential to determine if it’s the right fit for you. Consider your goals, availability, and skillset. If you’re looking for a flexible side hustle that allows you to explore your interests and earn extra income, this could be the perfect choice.

Check out the Scrambly website for yourself and see what you think. There is no cost and no risk in giving it a try!

Conclusion

In a world where financial stability and flexibility are highly valued, Scrambly offers a unique solution for those seeking a rewarding side hustle. With its diverse opportunities, user-friendly interface, and potential for significant earnings, it’s a platform worth exploring. So, why wait? Get started today and unlock your side hustle potential.

FAQs About Scrambly

1. Is it free to join?

Yes, Scrambly is free to join. You can create an account and start exploring opportunities without any upfront costs.

2. How do I get paid?

Scrambly offers various payment methods, including PayPal, Visa, Amazon, and others. You can choose the payment method that suits you best.

3. What is the minimum cashout?

You can withdrawal as low as $1.

4. Are there age restrictions for joining?

You must be at least 13 years old to create an account.

5. Can I work on Scrambly from anywhere in the world?

Yes, it is accessible from anywhere with an internet connection. It’s a global platform that welcomes users from around the world.

6. Are there any limitations on the number of tasks I can take on at once?

There are no strict limitations, but it’s essential to manage your workload effectively to ensure the quality of your work. It’s recommended to start with a manageable number of tasks and gradually increase your workload as you become more comfortable with the platform.

Rule of 72 Calculator: Unveiling the Magic of Compound Interest

CFA Level 3 – Notes, Formulas, Weights

Mastering the CFA Level 3 Examination: A Comprehensive Guide

Reaching the culmination of the Chartered Financial Analyst (CFA) program, the Level 3 exam stands as the ultimate challenge. This phase demands a practical application of investment management and portfolio principles, diverging from the preceding levels’ knowledge assessments. Within this critical juncture of your journey towards obtaining the esteemed CFA charter, a deep comprehension of the Level 3 exam’s distinctive format, crucial formulas, and topic weightages is paramount. This article delves into these pivotal aspects, steering you towards effective preparation.

Deciphering the Structure of the CFA Level 3 Exam

Distinguishing itself from the conventional multiple-choice approach of Levels 1 and 2, the Level 3 exam scrutinizes your aptitude for applying financial concepts in real-world contexts. It comprises two primary segments:

Morning Session: Constructed Response (Essay) Questions

The morning session of the Level 3 exam diverges from conventional formats, incorporating constructed response queries. These necessitate comprehensive, organized written responses that articulate concepts, perform calculations, and dissect scenarios. The morning session’s essence lies in your capacity to amalgamate knowledge into practical application.

Afternoon Session: Item Set Questions

Retaining the item set pattern akin to Level 2, the afternoon session acquaints you with vignettes or scenarios succeeded by multiple-choice questions linked to each case. This component evaluates your ability to synthesize information and formulate judicious decisions anchored in the presented contexts.

Vital Formulas for CFA Level 3 Success

Despite the Level 3 exam’s accentuation on conceptual grasp and application, certain formulas remain pivotal for triumph. These mathematical expressions frequently pertain to portfolio management, risk evaluation, and performance appraisal. Here are noteworthy formulas to internalize:

1. Effective Annual Rate (EAR):

EAR = (1 + (Nominal Interest Rate / Number of Compounding Periods))^Number of Compounding Periods – 1

2. Dietz Formula (Geometric Mean Return):

Dietz Return = (Ending Value – Beginning Value – Net Flows) / (Beginning Value + (0.5 * Net Flows))

3. Sharpe Ratio:

Sharpe Ratio = (Portfolio Return – Risk-Free Rate) / Portfolio Standard Deviation

4. Information Ratio:

Information Ratio = (Portfolio Return – Benchmark Return) / Tracking Error

5. Treynor Ratio:

Treynor Ratio = (Portfolio Return – Risk-Free Rate) / Beta of Portfolio

Allocation of Topics in CFA Level 3

A nuanced comprehension of topic weightages empowers strategic allocation of study hours. While slight variations can occur across years, the exam broadly encompasses the following domains:

1. Ethical and Professional Standards:

Echoing prior levels, this segment remains pivotal, emphasizing ethical conduct and professionalism within the investment realm. It incorporates the Code of Ethics and Standards of Professional Conduct.

2. Behavioral Finance:

Exploring psychological biases’ impact on investment decisions, this facet delves into investor behavior, market anomalies, and their repercussions on portfolio management.

3. Private Wealth Management:

Private wealth management entails tailoring investment strategies for affluent individuals. Encompassing risk management, tax considerations, estate planning, and client interaction, this domain is vital.

4. Institutional Portfolio Management:

Catering to institutional portfolio management, this sector encompasses asset-liability management, risk mitigation, and performance assessment.

5. Economics and Capital Market Expectations:

Analyzing macroeconomic elements’ influence on asset returns defines this domain. It embraces forecasting techniques, yield curve analysis, and the intricate interplay between economic indicators and investments.

6. Asset Allocation:

Signifying a cornerstone of portfolio management, asset allocation incorporates strategic and tactical dimensions. Risk budgeting, alternative investments, and their roles are central here.

7. Fixed Income and Equity Portfolio Management:

Mastery of managing fixed income and equity portfolios is indispensable. Valuation, risk analysis, and portfolio construction for these asset classes are focal points.

8. **Risk Management and Derivatives:**

Delving into risk typology and management, this segment addresses market, credit, and liquidity risk. Insights into derivatives and their applications also feature.

Parting Thoughts

The CFA Level 3 exam symbolizes a transformative juncture, demanding comprehensive grasp, practical application, and analytical finesse. As you embark on this journey, rehearsing essential formulas pertinent to portfolio management, risk assessment, and performance evaluation is critical. Allocate study hours astutely, recognizing the weightage attributed to diverse topics.

Understand that the Level 3 exam assesses your prowess in translating knowledge into tangible contexts. Mastering constructed response queries and refining essay composition skills enrich the morning session. Meanwhile, adeptness in dissecting vignettes and making informed decisions forms the crux of the afternoon session.

By embracing a systematic study strategy, anchoring formulas, and discerning topic weightages, you empower yourself to showcase proficiency and secure your standing as a CFA charterholder. Fortune favors the prepared; stride ahead confidently in conquering the Level 3 exam, propelling your financial career to new heights. Best of luck!

Why Car Dealerships Are The Worst!

Why Car Dealerships Are the Worst: Unveiling the Frustrations and Finding Alternatives

Do you ever get that sinking feeling when you think about visiting a car dealership? The pushy salespeople, the hidden fees, the seemingly endless negotiation process – it’s enough to make anyone’s blood pressure rise. In this article, we’re going to delve into the world of car dealerships and uncover why they often leave customers feeling frustrated and dissatisfied. But fear not, we’ll also explore some alternatives that might just save you from the dealership headache. Buckle up as we take a ride through the highs and lows of car shopping.

Table of Contents

- The Initial Excitement: A Shaky Start

- The Pushy Sales Pitch: A Turn-Off for Customers

- Hidden Fees and Surprises: The Shocking Reality

- Endless Negotiations: A Tiring Tug-of-War

- Quality Concerns: The Gambit of Used Cars

- Financing Fiascos: Tricky Terms and Rates

- Deceptive Warranties: Reading Between the Lines

- Time-Consuming Process: Ain’t Nobody Got Time for That

- Lack of Transparency: Leaving Customers in the Dark

- The Online Option: Is It Any Better?

- The Rise of Car Vending Machines: A Glimpse into the Future

- Seeking Simplicity: The Appeal of No-Haggle Dealerships

- Private Sellers: The Hidden Gem of Car Buying

- Car Consultants: Your Personal Car-Shopping Guide

- Empowerment through Knowledge: Making the Right Choice

The Initial Excitement: A Shaky Start

Ah, the thrill of buying a new car! But that excitement can quickly turn into dread as you step into a traditional car dealership. It’s like entering a lion’s den, and you’re the prey. The anticipation of driving off in your dream car is often overshadowed by the unease of dealing with aggressive sales tactics.

The Pushy Sales Pitch: A Turn-Off for Customers

You barely set foot on the lot before a salesperson pounces, armed with a rehearsed pitch that’s supposed to make you feel like you’re missing out if you walk away. The pressure to buy can be suffocating, leaving you wondering if you’re making a choice based on your desires or just to escape the salesperson’s clutches.

Hidden Fees and Surprises: The Shocking Reality

Congratulations, you’ve decided on a car! But hold on, what’s this extra fee? And that one? Many dealerships are notorious for tacking on hidden charges that can add thousands to your final bill. It’s a bitter pill to swallow after you’ve already committed emotionally to your new ride.

Endless Negotiations: A Tiring Tug-of-War

Negotiating the price of a car feels like an eternal struggle. The back-and-forth dance between you and the sales manager can leave you mentally drained and questioning if you’re getting a fair deal. Who has time for this exhausting game?

Quality Concerns: The Gambit of Used Cars

Buying a used car can be a gamble. While dealerships promise thorough inspections, some questionable vehicles still manage to slip through the cracks. That “gently used” car might turn out to be a lemon in disguise, leaving you with regrets and repair bills.

Financing Fiascos: Tricky Terms and Rates

Securing financing at a dealership might seem convenient, but the terms and interest rates aren’t always in your favor. Without fully understanding the loan jargon, you could end up paying far more than you bargained for.

Deceptive Warranties: Reading Between the Lines

Warranties sound like a safety net, but the fine print can unravel a different story. Some warranties are so riddled with conditions that getting a repair covered feels like winning the lottery. Is it worth the hassle?

Time-Consuming Process: Ain’t Nobody Got Time for That

Buying a car through a dealership can be a time-consuming ordeal. From the initial browsing to the endless paperwork, it feels like an eternity. Time is precious, and spending it all on a car purchase can leave you drained and frustrated.

Lack of Transparency: Leaving Customers in the Dark

Transparency? Not always a priority. Dealerships might withhold crucial information about a car’s history or condition, leaving you to make a decision without the full picture. It’s like buying a mystery box with your hard-earned money.

The Online Option: Is It Any Better?

Turning to online car shopping seems like a solution, but it comes with its own set of challenges. The inability to physically inspect the car and the uncertainty of dealing with strangers can make online car purchases a nerve-wracking experience.

The Rise of Car Vending Machines: A Glimpse into the Future

Enter the car vending machine – a futuristic concept that promises a hassle-free buying experience. Imagine selecting your desired car from a giant vending machine and driving away, all without the pressure of a salesperson breathing down your neck.

Seeking Simplicity: The Appeal of No-Haggle Dealerships

No-haggle dealerships are a breath of fresh air in the car-buying world. The price you see is the price you pay, eliminating the need for exhausting negotiations. It’s like buying groceries without wondering if the tomato’s price is negotiable.

Private Sellers: The Hidden Gem of Car Buying

While dealerships get a bad rap, private sellers often offer a more relaxed and transparent buying process. Plus, they usually have a personal connection to the car and can provide insights that a salesperson wouldn’t even consider.

Car Consultants: Your Personal Car-Shopping Guide

Imagine having your own car expert by your side. Car consultants are a rising trend, offering personalized advice without the push to sell. It’s like having a knowledgeable friend guide you through the labyrinth of car choices.

Empowerment through Knowledge: Making the Right Choice

The key to conquering the dealership dilemma is knowledge. Equip yourself with information about the car, its value, and your financing options. When you’re armed with facts, the power shifts from the salesperson to you.

FAQs: Navigating the Car Buying Maze

Q1: Are all car dealerships equally pushy? A: Not all dealerships are the same. Some have shifted towards a more customer-friendly approach, while others still cling to high-pressure tactics.

Q2: What’s the biggest advantage of buying from a private seller? A: Private sellers often offer lower prices and a more transparent buying experience, as they don’t have the overhead costs of a dealership.

Q3: Are online reviews of dealerships reliable? A: Online reviews can provide insights, but remember that experiences vary. Take them with a grain of salt and trust your instincts.

Q4: How can I avoid hidden fees at dealerships? A: Ask for an itemized breakdown of the fees and be prepared to walk away if they’re not transparent about the charges.

Q5: Are car vending machines really the future of car buying? A: While they offer a unique experience

Microsoft Rewards Review: Earn While You Explore the Digital Realm

Microsoft Rewards Review: Earn While You Explore the Digital Realm

Are you someone who loves exploring the digital world, discovering new apps, and engaging with exciting content? What if I told you that your online adventures could earn you real rewards? That’s right! Microsoft Rewards offers you the opportunity to earn points while you do what you enjoy most – browsing, shopping, and playing. In this comprehensive review, we’ll delve into the world of Microsoft Rewards, uncovering how it works, its benefits, and how you can make the most out of this rewarding experience.

Introduction

Unveiling Microsoft Rewards

Imagine being rewarded for the time you spend exploring the internet, shopping online, and even playing games. Microsoft Rewards, Microsoft’s loyalty program, offers precisely that. Designed to enhance your digital experiences, Microsoft Rewards allows you to earn points for performing various activities that you likely already do. These points can then be redeemed for a wide range of exciting rewards, from gift cards to sweepstakes entries and charitable donations. So, let’s dive into the details and see how Microsoft Rewards can transform your online escapades into something even more gratifying.

Getting Started

Joining the Rewards Program

The first step to reaping the benefits of Microsoft Rewards is to become a member of the program. Luckily, joining is a breeze. If you have a Microsoft account, you’re already on your way. If not, creating one is simple and quick. Once you’re in, just head over to the Microsoft Rewards page, and you’re all set to start earning those coveted points.

Navigating the Dashboard

Once you’re in the program, the dashboard will become your go-to hub. It’s where you’ll find all the available earning activities, your points balance, and information about your membership level. The layout is intuitive and user-friendly, making it easy to jump into various activities without any confusion.

Earning Points

Searching with Bing

Who knew that your online searches could turn into rewards? By using Bing as your search engine, you can rack up points with each query. The points are limited per day, but they accumulate quickly and effortlessly over time. It’s a small change that can lead to significant rewards.

Exploring Microsoft Edge

Microsoft Edge, the company’s web browser, offers yet another way to earn points. By using it regularly and completing the occasional bonus task, you’ll find your points increasing steadily. It’s a seamless integration into your browsing routine that comes with added benefits.

Taking Quizzes and Surveys

If you enjoy testing your knowledge or sharing your opinions, this is where the fun begins. Microsoft Rewards regularly presents quizzes and surveys on various topics. Not only are they engaging, but they also contribute to your points balance.

Shopping and More

Did someone say shopping? Yes, you can earn points by making purchases through the Microsoft Store. From apps to movies and beyond, your buying habits can finally start working in your favor.

Membership Tiers

Breaking Down Levels

Microsoft Rewards comes with different membership levels, each offering its own set of perks. The more points you earn, the higher you’ll climb in the tiers. This progression unlocks additional benefits and potentially even better point accumulation rates.

Climbing the Ranks for Greater Rewards

As you accumulate points, you’ll notice yourself moving from a basic member to higher echelons. These elevated levels bring advantages like bonus points, better redemption rates, and the sense of achievement that comes with leveling up.

Redeeming Your Points

Vast Array of Redemption Options

Now for the exciting part – redeeming your hard-earned points. The Microsoft Rewards catalog boasts a plethora of options. Gift cards for popular retailers, sweepstakes entries for a shot at big prizes, and donations to charities – the possibilities are diverse and cater to various interests.

Gift Cards, Sweepstakes, and Donations

Whether you’re a savvy shopper, a thrill-seeker, or someone who wants to make a positive impact, Microsoft Rewards has something for you. Treat yourself or contribute to a cause that matters – it’s all within your reach.

Gaming with Rewards

Xbox Game Pass Quests

Gamers, this one’s for you. If you’re an Xbox Game Pass Ultimate member, you can earn points by completing quests in select games. It’s a fantastic way to merge your passion for gaming with the joy of earning rewards.

Incorporating Rewards into Your Gaming Routine

Imagine leveling up in a game and in real life simultaneously. With Xbox Game Pass Quests and other gaming-related activities on Microsoft Rewards, you can do just that. It’s a win-win situation that adds an extra layer of fun to your gaming sessions.

Tips and Tricks

Maximizing Points Accumulation

While Microsoft Rewards offers plenty of ways to earn points, a bit of strategy can go a long way. For instance, combining Bing searches with Edge browsing and completing quizzes can lead to faster point accumulation.

Staying Engaged and Informed

New activities and opportunities appear regularly on the Microsoft Rewards dashboard. Staying engaged and checking in frequently ensures you don’t miss out on any chances to boost your points.

The Social Element

Sharing Rewards with Friends

What’s better than enjoying rewards? Sharing them with friends and family! Microsoft Rewards allows you to do just that. Spread the joy of earning points and discovering exciting redemption options together.

Community and Achievements

Being a part of Microsoft Rewards isn’t just about points and prizes. It’s a community of

individuals who share similar interests. Additionally, you can earn achievements for reaching milestones, adding a sense of accomplishment to your journey.

Fine-Tuning Your Experience

Personalizing Your Preferences

Microsoft Rewards understands that everyone’s interests are unique. That’s why the program lets you tailor your earning activities to match your preferences. Customize your dashboard and maximize your enjoyment.

Feedback and Improvement

Microsoft Rewards is a dynamic program that values user feedback. If you have suggestions or ideas to enhance the experience, the program welcomes your input.

Mobile Convenience

Earning On-the-Go

With the Microsoft Rewards app, your earning potential isn’t confined to your desktop. Carry the rewards experience in your pocket and earn points wherever you are, whether it’s on your daily commute or during a lunch break.

Security and Privacy

Data Protection and User Privacy

Microsoft is committed to safeguarding your data and respecting your privacy. Rest assured that your personal information is treated with the utmost care and attention.

Global Availability

Embracing Users Worldwide

Microsoft Rewards isn’t limited to certain regions. It’s a program with a global reach, ensuring that users around the world can enjoy its benefits and rewards.

Comparative Analysis

How Microsoft Rewards Stacks Up

As loyalty programs become increasingly common, how does Microsoft Rewards compare? In terms of versatility, rewards variety, and integration into your digital life, it stands out as a comprehensive and engaging offering.

Conclusion

In the ever-evolving digital landscape, Microsoft Rewards brings an innovative twist to online experiences. By transforming everyday activities into opportunities for rewards, it adds a layer of excitement to your digital routine. Whether you’re searching the web, shopping, or immersing yourself in games, Microsoft Rewards is your ticket to making the most out of your online adventures.

—

Frequently Asked Questions

Is Microsoft Rewards free to join?

Absolutely! Joining Microsoft Rewards is completely free. If you have a Microsoft account, you’re already on your way to earning rewards.

Can I earn rewards on any device?

Yes, you can earn rewards on a variety of devices, including your computer, tablet, and mobile phone. The Microsoft Rewards app ensures you can even earn on-the-go.

What are the most popular redemption options?

Gift cards for well-known retailers, such as Amazon and Starbucks, are among the most popular redemption options. However, the catalog offers a wide range of choices to suit different preferences.

How often do new quizzes and challenges appear?

Microsoft Rewards frequently updates its selection of quizzes, challenges, and activities. Checking in regularly ensures you don’t miss out on the latest opportunities to earn points.

Is my personal information safe?

Absolutely. Microsoft takes data protection and user privacy seriously. Your personal information is handled with the utmost care and is subject to Microsoft’s stringent privacy policies. Your online safety is a priority.

Microsoft’s PE Ratio Explained: A Guide for Investors

Microsoft’s PE Ratio is a critical piece of information for any savvy investor.

This metric, often overlooked by novices, holds the key to understanding Microsoft’s market value and its potential as an investment option.

The Price-to-Earnings (P/E) ratio might seem complex at first glance but fear not!

We’re here to break down Microsoft’s PE Ratio, making it simple and digestible for all types of investors.

Table of Contents:

- Deciphering Microsoft’s PE Ratio

- Decoding the Calculation of PE Ratio

- Dissecting Microsoft’s PE Ratio

- The Importance of Future P/E Ratios

- How Company Announcements Impact Stock Prices

- The Role of Cash Position in Valuation Metrics

- Decoding High PE Ratios

- Why Investors Should Monitor Microsoft’s Latest Analysis

- Mastering the Use of Price-to-Earnings Ratio in Investments

- FAQs in Relation to Microsoft’s PE Ratio

- Conclusion

Deciphering Microsoft’s PE Ratio

Investors can use the Price-to-Earnings (P/E) ratio to determine if Microsoft Corp stock is a good investment at its current price. As of August 24, 2023, the P/E ratio for this tech giant stands at an impressive 33.33.

This earnings ratio essentially tells you how much money an investor needs to put in to receive one dollar from the company’s profits. It gives us insights into what price the market is willing to pay today based on its past or future profit figures.

Microsoft offers detailed explanations about different ways of calculating P/E ratios – including trailing and forward methods which use historical data and projected earnings respectively.

Gauging Investment Worth with The PE Ratio

If two companies report similar revenues and profit margins but have divergent P/E ratios, it could suggest that one firm holds more value among investors than its counterpart.

A high P/E ratio might indicate higher growth expectations by investors compared with other firms within their industry bracket. Conversely, lower P/E values may point towards potentially undervalued stocks – providing opportunities for shrewd buyers who believe these estimates will be surpassed.

Evaluating MSFT Using Its PE Ratio

Diversified business models often lead to consistent performance as seen with Microsoft Corp whose ventures include cloud computing services through Azure platform, productivity software suite Office365, etc. This track record significantly influences stable EPS numbers, thereby positively impacting respective P/E values.

Next up, we delve deeper into understanding exactly how this crucial financial metric known commonly as ‘PE Ratio’ within investing circles gets calculated.

Decoding the Calculation of PE Ratio

The P/E ratio is a metric investors utilize to assess whether or not a stock’s price is appropriate. The formula for this calculation involves two primary elements: the closing price of company shares and its Earnings Per Share (EPS).

Earnings Growth Influencing PE Ratios

A significant factor in determining P/E ratios is earnings growth. Companies with higher growth rates often exhibit high P/Es as they reflect future profit expectations.

- If a company’s EPS grows faster than its share prices (‘share ÷’), then all else being equal, their PE would decrease since our denominator has increased at a quicker pace than our numerator (‘ratio = price’). This could be due to several reasons including but not limited to operational efficiencies leading towards better bottom-line results, etc.

- In contrast, if there’s any uptick within the firm’s share prices happening more swiftly compared to increases seen inside respective annual net income figures – such a situation might occur post a major positive news announcement causing an increase in investor sentiment – it leads to a rise within P/E metrics because now the numerator part has grown speedier vs the underlying denominator section (‘ratio = price’). These scenarios illustrate the ‘rates impacts’ on P/E calculations.

To put it simply, a high-growth tech giant may command elevated P/Es owing to robust anticipated earnings outlooks. However, remember these stocks also come attached alongside greater risk factors, especially should those lofty expectations fail to materialize down the line. Hence, careful considerations are needed before making investment decisions based solely on them.

We’ve just explored ways of calculating important financial metrics like P/Es and have discussed various aspects impacting them, i.e., changes occurring in either component parts which can cause variations over time, besides explaining why certain firms tend to show relatively larger values compared to others based on their specific expected performance forecasts, amongst other things too. Next up, let us turn our attention to specifically interpreting what exactly the standing figure means from the perspective of investing by taking a closer look at a case study revolving around understanding the significance behind the current value.

Key Takeaway:

Understanding Microsoft’s PE ratio involves recognizing the interplay between share prices and earnings per share (EPS). High growth rates can inflate this metric, reflecting future profit expectations. However, investors should tread carefully as high P/E ratios also indicate potential risks if lofty forecasts fail to materialize.

Dissecting Microsoft’s PE Ratio

The Price to Earnings (PE) ratio of a company, such as Microsoft Corporation, is an essential tool for investors assessing the value and potential growth of stocks. As we approach August 25th, 2023, the Microsoft PE ratio stands at a notable figure – 33.14.

Pitting Microsoft’s PE Ratio Against Software Industry Standards

To evaluate whether this Microsoft PE measure offers good value or not requires comparison with industry standards. The software sector has its own average P/E ratios that are influenced by factors like projected growth rates and risk profiles unique to it.

A higher than average P/E might suggest that market participants anticipate high future earnings from companies like MSFT or perceive less associated risks compared to other firms in the same sphere. Investopedia provides more insights on understanding these financial metrics better.

In contrast, lower P/E ratios could be indicative of slower expected growth or greater perceived risks involved with investing in those businesses. Data sourced from S&P Global Market Intelligence (source link here) reveals that during Q2 2023, the software industry had an approximate P/E ratio benchmark around 30x, which means the Microsoft PE falls well within range, making it competitive among its peers.

Digging Deeper Beyond Comparisons

Beyond mere comparisons, investors need to delve deeper. For instance, a detailed analysis on fundamentals such as revenue streams, business models, and even leadership can offer much-needed context behind numbers. After all, P/E Ratios should never be used in isolation but rather in conjunction with other evaluation tools to make informed decisions about investment opportunities.

Corporate Finance Institute (CFI) provides comprehensive guides interpreting various financial metrics, including Price Earnings Ratios, that might prove helpful for aspiring investors looking to gain a better grasp of the concept.

In our upcoming part, we’ll investigate why.

Key Takeaway:

Microsoft’s PE ratio, standing at 33.14 as of August 2023, is a crucial metric for investors to assess stock value and potential growth. It’s essential to compare this figure with industry standards and delve into fundamentals like revenue streams and business models for a comprehensive analysis.

The Importance of Future P/E Ratios

When evaluating potential investments, it is essential to consider more than just the present. Analyzing Microsoft’s Price-to-Earnings (P/E) ratio is especially important for making an informed investment decision. A future P/E ratio can provide valuable insights into what market participants expect about a company’s earnings growth.

This forward-looking metric provides an indication of how analysts predict the company will perform in upcoming years. If these predictions are positive with anticipated robust earnings growth, this could lead to increased stock prices and consequently higher future P/E ratios.

Understanding Future P/E Ratio Calculations

To compute the future P/E ratio, you need two critical pieces: projected EPS (Earnings Per Share) and the current share price. The process involves dividing the current share price by forecasted EPS, which gives us our desired ‘future P/E’ value.

Bear in mind that these figures rely on estimates – they are not guaranteed outcomes, hence should be used as part of your overall analysis rather than being viewed as definitive indicators alone. It becomes important, therefore, to take other factors such as historical performance data and broader economic trends into account while making investment decisions.

Analyzing Analyst Consensus Forecasts for Determining Future PE Ratios

A crucial component influencing investor sentiment towards specific stocks comes from expert opinions or analyst consensus forecasts. These play a significant role when calculating prospective P/E ratios.

If there is high confidence among experts regarding a strong performance outlook for Microsoft, it would likely result in heightened buying pressure, potentially leading to elevated prices and positively impacting its expected P/E ratio.

Risks Involved In Relying Solely On Predictive Metrics Like ‘Future P/E’

No single financial indicator should be relied upon exclusively during decision-making processes. While predictive metrics such as ‘future P/E’ may offer some insight into possible corporate performances, inherent risks exist due to their heavy reliance on estimated numbers that might deviate significantly from actual results due to various unforeseen circumstances.

Key Takeaway:

When eyeing Microsoft’s investment potential, don’t just consider the present P/E ratio. Factor in future P/E ratios too, which hinge on projected earnings and share price. But remember, these are estimates – not guarantees. Pair them with historical data and broader economic trends for a well-rounded analysis.

How Company Announcements Impact Stock Prices

Company announcements play a pivotal role in the fluctuations observed in stock prices. When companies release new information, particularly when it is price-sensitive, this can significantly influence investor sentiment and trading behavior.

The closing price of a company’s shares often sees significant changes following these latest price-sensitive company announcements. For instance, if Microsoft Corp reports higher than expected earnings or launches an innovative product line that captures market attention, investors may respond positively, leading to increased demand for their shares, which ultimately drives up the share prices.

In contrast to positive news driving up share prices, there are instances where negative news such as missed earnings targets or regulatory issues surface. These types of scenarios could potentially decrease investor confidence, causing a drop in share prices. Therefore, staying updated with these updates becomes crucial as they provide valuable insights into potential future performance and risks associated with your investment.

Navigating Share Price Increases Following Positive Announcements

A well-received announcement from Microsoft Corp might include surpassing quarterly revenue expectations or introducing breakthrough products that gain consumer approval quickly. Such optimistic developments tend to boost confidence among investors, prompting them to buy more stocks, hence pushing up the closing value.

This surge isn’t merely temporary; it also impacts long-term valuation metrics like the P/E ratio since it mirrors improved earning prospects for the firm moving forward. Hence, understanding how different types of announcements impact is critical in making informed decisions.

The Effect of Negative News: Case of Decreasing Stock Values

Conversely, unfavorable corporate revelations lead shareholders to offload their equities, resulting in falling values. A clear example was during the global financial crisis in 2008 when lower profits were reported, leading to a sharp decline in many firms across sectors. In the case of a sudden dip due to bad news, a patient and savvy investor can see an opportunity to buy undervalued stocks and reap benefits once they recover. However, caution must be exercised in assessing the severity and implications of a particular piece of negative news before deciding whether to hold, sell, or invest additional funds into a given security.

Key Takeaway:

Company announcements significantly sway stock prices, with positive news boosting investor confidence and driving up share values. Conversely, negative revelations can prompt a sell-off, causing a dip in stock prices. Thus, staying abreast of these updates is crucial for informed investment decisions.

The Role of Cash Position in Valuation Metrics

Valuing a company involves various metrics, one of which is the Price-to-Earnings (P/E) ratio. This particular metric can be significantly influenced by the cash position of a company.

A firm’s net cash position is indicative of its financial stability and attractiveness to investors. It suggests that the business has sufficient resources for operational expenses, growth investments, or even surviving economic downturns without relying on external financing.

Digging Deeper into Net Cash Position

In essence, ‘net cash’ refers to liquid assets minus total liabilities – basically how much money would remain if all debts were paid off using only short-term funds at hand. A strong net cash position implies flexibility for strategic moves such as acquisitions and provides a buffer against unexpected costs or drops in revenue.

Cash Positions Impacting P/E Ratios

Firms with substantial free-cash-flow tend to command higher valuation multiples due to their perceived ability to generate consistent earnings over time regardless of broader market conditions. Investors may therefore pay more for each dollar earned by these companies compared to those struggling with tighter liquidity constraints, leading to potentially inflated valuations reflected through increased P/E ratios. For instance, a technology giant like Microsoft Corp might have an elevated PE owing to significant net cash positions.

Beyond The Balance Sheet: Other Considerations

Relying solely upon a single factor while making investment decisions isn’t advisable – including just looking at the current cash position. However, it plays a crucial role within the wider analysis process alongside other factors such as profitability margins and debt levels. Therefore, understanding this concept will help make informed decisions about your potential risks and returns profile.

As we delve deeper into our exploration of investing wisely, it becomes essential not merely to look at the present scenario but also future prospects. In the next section, let us decode what high Price-to-earnings (PE) Ratios mean, especially when considering buying stocks of MSFT.

Key Takeaway:

Microsoft’s elevated PE ratio can be attributed to its strong net cash position, reflecting financial stability and consistent earnings potential. However, investors should not solely rely on this factor but consider it within a broader analysis including profitability margins and debt levels for well-informed decisions.

Decoding High PE Ratios

Many investors are perplexed by a high P/E ratio, wondering if the stock is overpriced or presents good value. It’s not uncommon to question whether such stocks are overpriced or if they offer good value.

The Role of Earnings Yield in Deciphering High PE Ratios

Earnings yield is one way that investors interpret high P/E ratios. Earnings yield, the inverse of P/E ratio, reveals how much investors can get in earnings for each dollar put in.

In comparison across different stocks or sectors, earnings yield provides another perspective on valuation. A higher earnings yield could indicate better relative value compared to other investment options.

If companies have significantly grown their earnings, a high P/E may indeed be justified as this indicates strong future potential.

However, before making any decisions based solely on this metric, consider factors like market conditions and industry trends too. Multiplying the stock cost by total issued stocks provides an approximation of what it would require to purchase all available shares at current costs.

Differentiating between Genuine Growth & Speculative Bubbles

To make informed decisions involving investments into companies having elevated P/E ratios, differentiate between genuine earning growths driving up share prices versus speculative bubbles inflating them artificially. An inflated bubble driven more by speculation than actual financial performance risks bursting, causing significant losses, while true earning growth generally leads towards long-term profitability even when initial entry costs appear steep due to associated elevated P/E ratios.

Navigating through Market Capitalization alongside Elevated PE Ratios

Larger corporations tend to command larger market capitalizations, sometimes resulting in increased P/E ratios too. These organizations usually operate at scale with established products/services generating steady revenue streams, justifying their lofty valuations.

Moving forward, we’ll discuss why keeping track of Microsoft’s latest analysis becomes crucial, especially when dealing with complex metrics…

Key Takeaway:

Don’t be daunted by high P/E ratios; they may indicate strong future potential if backed by significant earnings growth. Use the earnings yield to gauge value, but consider market conditions and industry trends too. Differentiate between genuine earning growth and speculative bubbles to avoid pitfalls. Remember, large corporations with steady revenue streams often justify their lofty valuations.

Why Investors Should Monitor Microsoft’s Latest Analysis

The ever-changing landscape of the investment world can significantly impact a stock’s value, such as Microsoft (MSFT). A multitude of factors like market trends, economic indicators, and company announcements play crucial roles. Therefore, keeping an eye on the latest analysis on MSFT is vital for investors.

An informed investor will closely monitor changes in the stock price. Noticing fluctuations could indicate potential opportunities or risks. This vigilance allows them to make timely decisions about whether to buy stocks or adjust their portfolio accordingly.

Finding Reliable Sources for Microsoft Analysis

A reliable source of information can provide an invaluable edge when investing in stocks such as Microsoft. Financial news outlets, investment research firms, and reputable financial blogs often feature expert commentary and detailed analyses that shed light on a company’s performance.

Besides these sources, many brokerages offer comprehensive research tools as part of their service offerings. These resources typically include real-time quotes, charts tracking historical prices, and more.

Paying Attention To Analyst Ratings And Predictions

Analytical ratings – usually expressed as ‘buy’, ‘hold’, or ‘sell’ – are important signals regarding expected future performance based upon current data available. Though analyst predictions may shape investor sentiment, they do not guarantee future performance. Hence, always consider multiple viewpoints before making any decision related to your investments.